AIUI, the better position is to be non-based, because that sidesteps any import VAT issues, and should remove any “good reason” for a police/customs inspection within the EU.

An N-reg should now rank same as a G-reg, and for a non EU based pilot, the stuff like the often-reported N-reg hits at LFBZ should become pointless.

@Airborne_Again wrote:

Apparently still people expect the UK to get some kind of preferential treatment from the EU. (For old times sake?)

Well, yes. Of course we all expect that. Or rather, for our part, Brits don’t expect to treat our allies like Norway, Germany and Cyprus as if they were Myanmar or China or Patagonia.

Not just “for old times sake” (our common European history) but also because of our shared language, our culture, our common geo-political objectives, our respect for capitalism, property and the rights of man, and the fact that, if push comes to shove, we have each other’s backs. Our soldiers train together and yes, my company supplies the silencers for the British rifles which brave young Swedish snipers use to keep your country free and safe.

But most of all, Brits expect to give “preferential treatment” to EU/EEA member states BECAUSE WE LIVE NEXT TO EACH OTHER and as we all know, life is immeasurably more pleasant and fruitful if we make an effort to help our neighbours. I’m sure that in your country as in mine, you know the names of your neighbours and their dogs, and maybe even their children  , that you help each other without pouting about “reciprocity” as one petulant EU apparatchik likes to do, that you exchange small gifts at Christmas, etc. That’s a normal human “society” built on common decency.

, that you help each other without pouting about “reciprocity” as one petulant EU apparatchik likes to do, that you exchange small gifts at Christmas, etc. That’s a normal human “society” built on common decency.

But good neighbours also don’t sign agreements then unilaterally ditch them without discussion.

Something which you blamed the EU apparatchiks for despite it never being put in place and only lasting 3hours.

Btw what shared language?

I read through the Opmas article referenced here.

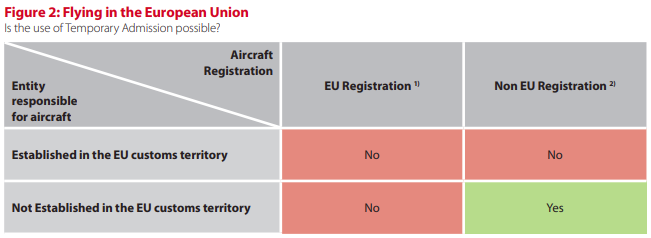

There are curious circumstances where the aircraft reg matters. It is to do with the “temporary admission” (TA) option.

However, I wonder in what circumstances a pilot who is based in Europe, and has been for some time, would be flying under a TA. It may actually be applicable to UK pilots:

the aircraft must be registered outside the EU and – as a basic rule – be used privately by a non-EU resident. TA involving EU residents and/or commercial activities comes with certain restrictions and limitations. The primary intention of the relief is to grant the private user free access to fly unhindered in the EU member states. If the conditions are met, TA is a paperless routine and admission is granted automatically when crossing EU borders.

But there is a big gotcha with using TA:

Passenger and crew allowed on board

The rule of thumb is still that a TA aircraft on an internal EU flight should not carry any EU residents on board except for the exemptions quoted from the EU Union Customs Code (2016) below:

‘Natural persons who have their habitual residence in the customs territory of the Union shall benefit from total relief from import duties in respect of means of transport which they use commercially or privately provided that they are employed by the owner, hirer or lessee of the’…

So if such a UK pilot flew into France, picked up a French pilot because he wants to fly on to an FR-only airport, he could get busted for this.

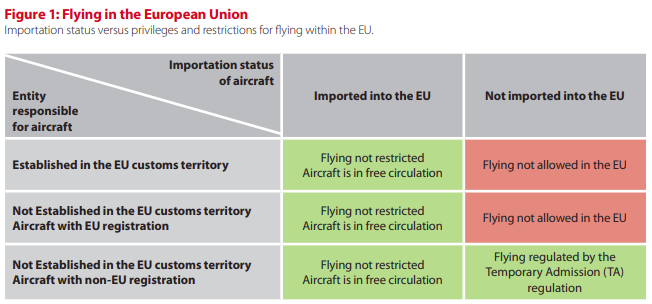

However I would think all UK based planes which were in the UK at 31 Dec 2020 will get the benefit of “full importation”:

Note the interesting bits in red in the above. I would think ferry pilots need to be extremely careful with this!

Obviously, this guy makes money with an aviation consultancy, but the above is nevertheless interesting. It may affect, for example, a UK resident pilot who has an EU passport and imported his plane into Europe after 31 Dec 2020.

I haven’t seen anything which suggests a “normal” UK based pilot of a G-reg or N-reg would be at risk on a trip to the EU, assuming his aircraft was fully imported at some point, and would be OK carrying an EU citizen too. The “fully imported” bit does however hang on the old question of whether EU VAT was once paid, but isn’t that the job of the UK to check this, post-31/12/20, rather than the EU’s? I am not sure… If an EU inspector decides you are flying on a TA and he catches you carrying an EU citizen, and you can’t prove VAT was once paid, you have a problem.

Can anyone see a problem with this reasoning?

I have no expertise in this area. The only comment that I would make is that that document is dated Feb 2017. As we all know a lot has happened since then between the EU and the UK. It’s likely that the document needs some updating and may not represent the current position. It may turn out to be up to date, but I’d be cautious about relying on it.

Yes; I think one key Q is whether anything has changed in the way Brussels treats VAT specifically wr.r.t. brexit. I suspect nothing has changed, and the UK has merely become a non-EU country, like most of the ~200 other countries.

The other Q is whether anything has recently changed in the EU on VAT generally. Quite possibly not, and that would belong here.

What happens if a UK buyer buys an EU based plane which is being sold “VAT paid”?

It is EU VAT paid but not UK VAT paid.

Don’t you have to pay UK import VAT regardless of whether VAT was paid on it already in the EU?

My understanding, and I haven’t really looked into it, is that normally the answer would be YES. You’d have to pay UK vat. But I believe the UK decided to recognise EU VAT as satisfying UK VAT for imports for two years from 1 Jan 2021 if the aircraft was situated in the EU on 1 Jan 2021.

Without further change that grace period ends on 31 December 2022.

My accountant who spoke with HMRC says only custom duty is due, VAT is due at point of sale, not on import.

Peter wrote:

What happens if a UK buyer buys an EU based plane which is being sold “VAT paid”?It is EU VAT paid but not UK VAT paid.

Don’t you have to pay UK import VAT regardless of whether VAT was paid on it already in the EU?

That’s correct. And even if you bought the plane in the UK but it was parked in the EU on Brexit night you can’t sell it Vatpaid in the UK. Here is the quote from the previously mentioned, and paid for, VAT advice.

“And if you sell the aircraft to anyone in the UK, they will have to import it and pay the UK import VAT. Selling within the EU, is a private sale and not Vatable.”

And if it’s a G-reg or you are established in the UK you can’t even fly it back to the UK, let alone sell it, because you can’t get a Temporary Admission either for a G-reg or if you are UK based (maybe Returned Goods Relief could be an option).