Peter wrote:

I have just read somewhere that for aircraft built and bought in the EEA and which have never been outside the EEA, then the VAT invoice issued at the original time of purchase would suffice as proof of VAT paid.

I am confused about the reference to EEA VAT (instead of EU VAT). Specifically Norway (and Iceland too I suppose.)

I have a DA42 (never been outside of EEA) and registered and VAT paid in Norway (in EEA but not EU). Does this plane count as VAT Paid for the whole EEA? I had presumed just Norway and that some day I am stuck in the country for the resale market when the time comes.

If anyone has any knowledge if selling a privately owned (VAT paid) plane form Norway / Iceland if one is “stuck” in their local country or not (unless they are willing to lose their entire 25% VAT “investment”) that would be welcome insight.

sedatedokc wrote:

I am confused about the reference to EEA VAT (instead of EU VAT). Specifically Norway (and Iceland too I suppose.)

That must just be a slip. The EEA does not include the EU customs union so trade between the EU and non-EU EEA countries is subject to VAT in the same way as any non-EU transaction.

@lionel may know more but I would expect the VAT in Norway and Switzerland to be unrelated to VAT in the EU, in the same way that EU VAT is now (post brexit) unrelated to UK VAT, and would be unrelated to VAT in Botswana (if Botswana had something called “VAT”).

Yes, AFAIK, VAT in Switzerland, Norway, Iceland (as well Armenia, Barbados, Chile, China, Israel, Mexico, the Philippines, South Africa, … as well as GST in Singapore, New Zealand and Canada, etc) is unrelated to EU VAT. Having paid any (or all…) of these does not exempt from paying EU VAT on importation in the EU.

The same applied to Jersey/Guernsey GST even before Brexit (but Isle of Man VAT was EU VAT), and still applies to the IPSI in Ceuta & Melilla, IGIC in the Canary Islands and any similar tax (if any; many/most don’t have any) applied in Greenland, Faroe Islands, Åland Islands, Heligoland, Büsingen, the French Overseas Territories and Regions, Mount Athos, Livigno, Campione d’Italia, Lake Lugano, Netherlands Antilles, San Marino, Andorra and Vatican City.

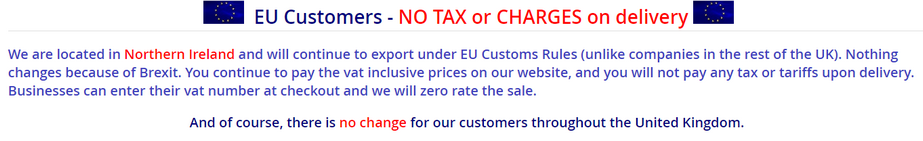

Northern Island VAT is supposed to be EU VAT for goods (not for services), as long as the Northern Ireland protocol is renewed periodically with the repeated consent of the Northern Ireland Legislative Assembly, but I kinda lost track of the many changes in all directions there.

Northern Island VAT is supposed to be EU VAT for goods (not for services)

Now that is amazing. Never thought of that!

Does that also mean that N Ireland VAT is not connected to UK VAT? If it is connected then that provides a route, doesn’t it?

Not that I ever understood the “N Ireland protocol” stuff, either

Peter wrote:

If it is connected then that provides a route, doesn’t it?

While the details are super difficult what is sure is that this is exactly the kind of thing the EU officials do not want and will change the rules once they learn about it ;-) This is the core of all the issues. After all nobody cares about the few inhabitants of N Ireland purchasing their groceries both sides to get along. But once their business becomes to simply shift large amounts of stuff from one system into the other exploiting their special status on both ends…

sedatedokc wrote:

If anyone has any knowledge if selling a privately owned (VAT paid) plane form Norway / Iceland if one is “stuck” in their local country or not (unless they are willing to lose their entire 25% VAT “investment”) that would be welcome insight.

Better ask an expert but I assume you are stuck in the country. When I deal with customers in Norway the EU seems to treat them VAT wise like any other bit of the world outside the EU customs union. But they do not seem to charge duty or go on about different technical norms etc. on top of VAT because of the special status. So the smaller the country the more incentive you probably have to hold the plane in a company if you ever plan to resell.

If such a VAT route ever came to exist, it would inevitably be done like the Danish zero VAT route i.e. some enterprising individual sets himself up like that Danish lawyer did and milks it for all he can get (like that Danish lawyer did), setting up his fee at the highest possible level at which people still get a saving  I was offered the Danish route in 2002 but could not be bothered for the relatively small net saving, and I thought it smelt dodgy. And sure enough then there was this which as a risk cannot ever totally go away, in any modern tax system.

I was offered the Danish route in 2002 but could not be bothered for the relatively small net saving, and I thought it smelt dodgy. And sure enough then there was this which as a risk cannot ever totally go away, in any modern tax system.

The NI business is a very handy club

for beating the UK on the head with  It’s not going to get solved anytime soon.

It’s not going to get solved anytime soon.

This Northern Ireland company confirms some previous discussions:

This is applicable. It is one of those areas which Brussels hopes will not become a big thing.

That is pretty amazing. Surely it must create scope for a bit of arbitrage? Ship goods from Great Britain to NI then ship them under EU regs from there to the EU?

Not that amazing – and many companies are doing just that