Peter wrote:

But why would somebody want to send you a password?It is trivial to send somebody an SMS, appearing to come from any called ID. My old Nokia 6310i phone could do that, when using with some free PC apps, and a cable.

The scammer has gone onto a website or banking application that requires MFA via SMS, but of course they don’t have your phone. They try to log into the banking website, and it sends an auth token (number) to the account owners mobile phone, which the gullible victim provides to the scammer over the phone. Bam. They are in your account and can transfer your money away. Happens many times a day, unfortunately.

Do not underestimate these scammers – they are very good at what they do, and they will successfully trick you if you are not careful. They are doing it all day, every day, refining their craft, and are very agile. There are plenty of things you can do to avoid this, but they require some forethought. Don’t give information to someone on the phone that called you. Don’t trust a phone number that you looked up on the internet. Don’t trust something you received in the mail – either email or post.

If you have a lot of money, the scammers can play a “long game” with you – they will invest years trying to get your money. They even set up fake financial institutions in offices in places like London with dozens of employees. They hire employees that are not even aware of the scam. It’s a huge industry, and very successful. And you are their target.

which the gullible victim provides to the scammer over the phone

Anybody who does that is completely stupid (nowadays) and will get ripped off on every corner.

There is however an extra step nowadays. Here in the UK; not sure if the mainland does it: to actually get money out, you obviously have to create a new payee. At this point the purported name of the payee is checked against the name of the account which the money is being transferred to. It is a fuzzy comparison, but fails if the names are quite different. Recently I had to pay a carpenter and had lots of trouble with this (the guy was trading under a name quite different from his bank account; there are various reasons for this, to do with stupidity, incompetence, or tax evasion).

So the scammer needs an extra stupid client these days

Don’t trust a phone number that you looked up on the internet

Actually the opposite is often true – in cases where you get an email giving you “new bank details” of a supplier  We had previous threads on this. It is the biggest scam right now, in both private and B2B, and there is no good solution to it. You have to phone up the sender of the email, on a published phone number (on their website). 100% necessary with Chinese suppliers today; today’s China is largely run by gangsters, scammers and fraudsters.

We had previous threads on this. It is the biggest scam right now, in both private and B2B, and there is no good solution to it. You have to phone up the sender of the email, on a published phone number (on their website). 100% necessary with Chinese suppliers today; today’s China is largely run by gangsters, scammers and fraudsters.

MichaLSA wrote:

Maestro is history (as is V-Pay) and the last remains will vanish until July 2023. Most of the Maestro attached cards were already pulled and changed into Debit cards.

Yup, just had that happen to me. Maestro has disappeared and the cards were replaced with Mastercards.

Peter wrote:

Unfortunately claiming money back for “undelivered services” is difficult.

I suppose that very much depends on the credit card company.

I only had to do this a few times. On my Mastercard Gold it was never a problem, even one which surprised me that they did act on it. Visa was slightly more hassle but worked out. Never had to do it on Diners so far.

The most surprising case was when I missed a plane due to early closing of check in at Sofia Airport. I tried to reason with the airline and they made me sufficiently mad that I actually went to the credit card company and told them what happened including the complete bill for the ticket. They did refund the unused leg including taxes within 3 days! I was totally surprised by this, very positively so. Mastercard Gold.

Interesting article on Revolut

They are not liable for some types of fraud, apparently.

…was a victim of what is known as an “authorised push payment fraud”. This is when fraudsters persuade their victims to send money themselves.

About 10 High Street banks are signed up to a code – the Contingent Reimbursement Model Code – which aims to give money back to people who fall victim to this kind of scam.

But Revolut is not a UK bank, and is not signed up to this code.

It is an e-money company that offers digital banking services.

It does not have a UK banking licence. It applied for one in January 2021 but is still waiting for the outcome.

I got scammed ~6k by some Revolut based scam going via Halifax. Halifax refunded it.

Peter wrote:

Interesting article on Revolut……. It is an e-money company that offers digital banking services. It does not have a UK banking licence.

The same issues as with Paypal. I wouldn’t touch either with a 10 feet pole.

Airborne_Again wrote:

The same issues as with Paypal. I wouldn’t touch either with a 10 feet pole.

What’s wrong with this one? Here it is a regulated service…

I dislike Paypal as a vendor (not reliable enough as an API for our online shop, ~99%, and reportedly they practically always side with the customer, using a crude algorithm) but it is good for customers which I frequently am personally. I’d same the same for Amazon actually but that’s another topic.

With PP I have managed to get money back from crooked Italian ski shuttle drivers, while another one (Halifax, credit card) took many months and much of my time submitting evidence.

She questioned why Revolut had not stopped transactions that had not followed her normal behaviour patterns, as banks do.

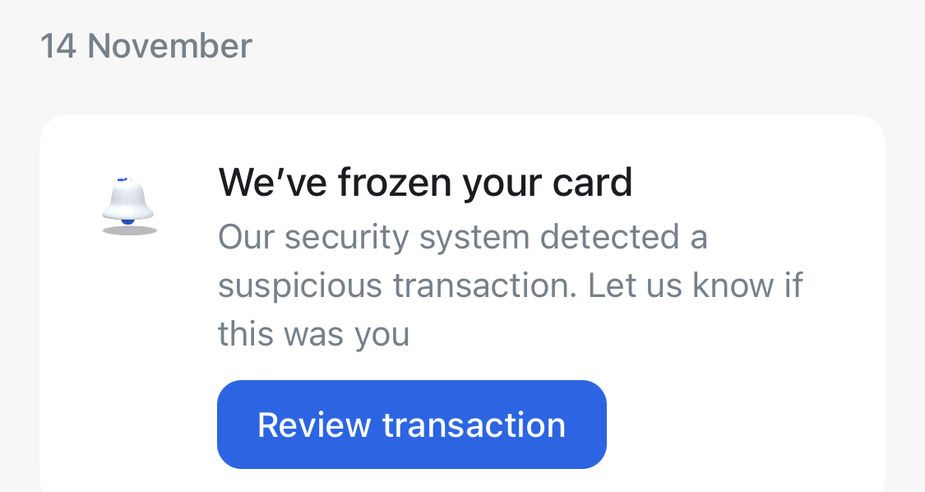

This happens when they spot suspicious transaction:

And trust me they are much better in this than majority of the high-street banks.

So actually Revolut did that but she insisted on executing transactions. No mechanism can prevent people from being scammed if they are naïve.

In general, there are no issues with Revolut. They operate within EU banking environment and they have banking license, so it’s not e-money company.

But… which of several transactions? Also text messages can take hours to be delivered.

That article differs re their banking license.

That article differs re their banking license.

The article says Revolut doesn’t have UK banking license. Which is true. But irrelevant.

But… which of several transactions? Also text messages can take hours to be delivered.

Revolut doesn’t use text messages, they use in-app notifications and while suspicious transaction is not explicitly approved it’s on hold. So she clearly approved it after being warned by Revolut and persuaded by fraudster to approve it.