Malibuflyer wrote:

The Hashcheck is a node based thing. Therefore fraudulent nodes do not need to do the hashcheck. All they need is the hash from the TRX that put the 1 btc in your wallet. And this is public in the chain.It is exactly the point of a 51% attack that more than half of the nodes do not check if the trx is actually authorized by the current owner but just put it as a valid trx in the chain.

It seems to me that you don’t really understand how it works.

China certainly does not have more than 51% of nodes as I pointed out previously

Hashchecks need to be completed and valid within the bitcoin protocol. You cannot just create a transaction and sign it out of a wallet without the private key of that wallet. The chances of randomly creating a key which would create the right hash for the transaction are effectively computationally impossible.

The bitcoin system doesn’t allow for you to just inject wallet transactions from existing addresses on the blockchain and insert them into a new block. They would not validate.

A 51% attack can only double spend. Or try to reject certain transactions by being an effective monopoly.

Maoraigh wrote:

What makes today’s bitcoin investors more secure than earlier tulip investors?

The quantity of tulips was not limited.

The tulips had a natural expiry date (actually I think they never traded grown tulips but just the bulbs)

Better compare Bitcoin to a rare metal without any technical use case. The quantity is limited, mining it becomes more and more expensive the less is left to mine, the value is only in the trust of the users as such metal has no industrial demand.

Bitcoin is a great piece of engineering but the proof of work at its base is

simply using too much energy. I did a PhD many years ago on proof of work

technology and you should have seen the faces of the professors when they

first heard of this “crazy” concept ;-)

It is immediately obvious that bitcoin does not scale to take the role of a global currency. The total energy consumption to replace even half of all transactions at the current difficulty level outstrips the current world energy consumption by more than an order of magnitude, and there are massive scaling issues other than energy that make it not viable in volume, including its value.

It is also immediately obvious that the Wright Flyer is not a sustainable means of transport. It is of unsafe construction, difficult to control, and only flies short distances with next to no payload. It will never replace carriages, and neither will these noisy contraptions called “motor cars”.

There are then of course people wo are addressing these obvious flaws (and some of the non-obvious ones), some of them layered on top of Bitcoin and some of these are solved in other digital coins.

But there are two things worth remembering

The one issue nobody (to my knowledge) has addressed so far is the one Sebastian_G wrote:

but the proof of work at its base is simply using too much energy

This is more about economics than about technology, and more precisely about the price paid for “proof of work”.

These issues can also be solved, but because they are an economic and political problem, they are MUCH harder.

What are the benefits of bitcoin versus the original e-cash proposals, where you had a “wallet” etc and could transfer the money from one wallet to another?

They all involved currency issued by some bank (signed by the bank, obviously).

The best of those proposals would have been totally untraceable while “out there”, same as cash really, so that got killed pretty fast. Then various existing players like Visa tried to get in on the action, with proposals which would have provided traceability, and then everybody who might use it lost interest  There were, and remain, excellent reasons for the €500 note, and it wasn’t just selling a house in Spain

There were, and remain, excellent reasons for the €500 note, and it wasn’t just selling a house in Spain

Peter wrote:

What are the benefits of bitcoin versus the original e-cash proposals

The general problem to be solved is double spending of tokens. Most other things are quite easy to solve with digital signatures etc. The only known method to avoid double spending (so you sign a transaction to A and then another to B) is some sort of more or less central registry or a physical token like the 500 Euro bill. This if far beyond bitcoin. For real estate you have government paperwork keeping track, for cars the government also has a central registry, for traditional bank accounts the bank and central bank keep a central database.

Now to keep such central database the classic option is to have some central organization. This is usually very efficient and works very well until it does not. Bank transactions in western countries are very reliable in normal cases but when it comes to more complex transactions the central organization can become the weak point. It will always be under political pressure.

To give an example a while ago I tried to pay for electronic parts from Asia and the transaction did simply disappear. My money was gone and the recipient did not receive it either. Later a letter came as it got help up by anti terrorist algorithms and now a lot of paperwork like invoices etc. was required. Eventually they money did arrive at the recipient about 1 month later, no excuse, now clue which court to go to file a lawsuit etc. Or before I did purchase a plane. The seller was told my transaction is booked in without any possibility for dispute etc. two days later my phone rings and the lady asks if I really want to send so much money to the seller? A simple no on the phone and the seller would have been without plane and without money.

So some people are interested in an alternative payment system which is indifferent like a machine. No political pressures etc. You enter a transaction and it gets booked no matter what. As so far any central organization proved to be not suitable distributed consensus mechanism are supposed to replace them. As in an anonymous world distributed consensus is difficult as anybody could vote a trillion times all the “proof of” mechanisms have been invented. In the end they limit your voting power to some form of resources you have.

Unfortunately at some point all such distributed consensus mechanisms will be very inefficient. Some more and some less but there is a reason we do not hold a general election for every real estate deal in the country to validate this deal by the majority of the voters.

Again I think the problem we are trying to solve rarely exists in most western counties right now. Just do a cheap bank transfer and be happy. But other parts of the world and maybe other times in the future might be different. The perfect solution for this problem would be some uncheatable central organization immune to any external political powers.

In the distant past this used to be to some degree Swiss banks keeping anonymous password protected accounts. But Switzerland did not withstand international pressure and such accounts no longer exist. So the real solution is to design an efficient central accounting database which by its location and design is completely independent and uncheatable. Maybe we can ask some extra terrestrians genetically unable of fraud to run our banking on Proxima Centauri…

The one issue nobody (to my knowledge) has addressed so far is the one Sebastian_G wrote:

but the proof of work at its base is simply using too much energy

Do you mean not addressed in this thread or not addressed by any coin developer? If the latter, once the currently planned upgrades to the Ethereum network are implemented (I think in the first half of 2022 but may happen faster), ETH 2.0 will work with “proof of stake” instead of “proof of work”, allowing for more efficient transaction verification by only one or a few miners at a time. Cheating will be discouraged by threatening the loss of the staked Ether coins of the miners: https://fortune.com/2021/05/27/ethereum-founder-vitalik-buterin-proof-of-stake-environment-carbon/

There are also projects like IOTA which would enable feeless transactions if they can make it work.

Bitcoin will indeed in the long run have the problem that there won’t be any incentive for validating transactions any more. Maybe around 2040 it will reach the tipping point.

The only known method to avoid double spending (so you sign a transaction to A and then another to B) is some sort of more or less central registry or a physical token like the 500 Euro bill.

In principle this is trivially addressed by using a secure smartcard chip, which will not allow you to spend a token twice. If you spent a token, it disappears from the wallet, because it got transferred to another wallet.

Of course this is only as secure as the smartcard chip itself, and the crypto underlying the transfers. A huge amount of work has gone into tamper-proof smartcard chips, over the past 30+ years, after various hacks were demonstrated (e.g. cooling it down until parts stopped working and then it would crash and do a memory dump, etc, etc).

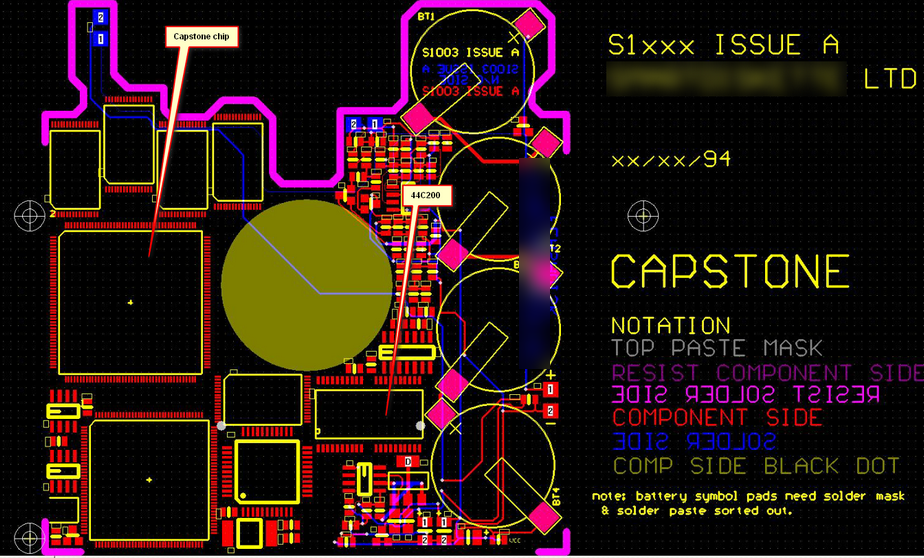

When I was doing contract design in the 1990s, I designed a product which had a Siemens 44C200. It can still be found on google and e.g. mentioned here. one data sheet. This goes back about 25 years and already the common hacks were known then – listed in the data sheet.

But I guess nobody was prepared to trust them completely… plus the permanent uncertainty of the security of RSA, and the impossibility of proving that some algorithm is NP-hard. But people and govts are prepared to trust banknotes which are not hard to forge, and IIRC ~1% of banknotes in circulation are believed to be forged.

Also nobody could be quite sure of a back door like the infamous Clipper/Capstone. Yes; I did a design with that too

The above was 27 years ago. I wonder what Bitcoin actually changes…

Peter wrote:

In principle this is trivially addressed by using a secure smartcard chip

In the end it comes down to human trust and while it seems possible to design hardware which can not be tampered with by random people on the street I think no chip can be regarded as secure if physical access is possible. Also in a worldwide distributed enviroment where by design the algorithm must be more or less public how do you know the recipient of your transaction is actually using such a chip. He could be using a version run in some virtual machine. And then he/she could clone the virtual machine and then go on and double spend the tokens. It might be a little easier where a central authority issues the cards (like phone cards) in the 1990ies and where the card holders can only spend money and not receive any. But once they can also receive it gets a lot more difficult and you would trust on some crypto key which can not be extracted from the hardware.

Rwy20 wrote:

[About the energy consumption of bitcoin] Do you mean not addressed in this thread or not addressed by any coin developer? If the latter, once the currently planned upgrades to the Ethereum network are implemented (I think in the first half of 2022 but may happen faster), ETH 2.0 will work with “proof of stake” instead of “proof of work”, allowing for more efficient transaction verification by only one or a few miners at a time.

Not addressed by reality ;-)

As I wrote this is an economic (and ultimately behavioural) problem that cannot be solved by technology alone. Proof-of-stake cryptocurrencies have existed for a long time (so it is “solved”) and so far haven’t gained traction (“but not really”).

Second-layer concepts on top of established proof-of-work coins, and the transition of Ethereum can all technically solve the problem, but that does not guarantee adoption. For example, bitcoin is seen as the crypto currency, with Ethereum being second. Unless people see reason to switch (cost, trust, etc.) they can invent all the technology they want.

Unless people see reason to switch (cost, trust, etc.) they can invent all the technology they want.

Ethereum has more use cases than Bitcoin and evolves faster. It is mainly a network of blockchain developers. I think if ETH 2.0 is implemented successfully, it will be more useful than Bitcoin, which will bring more widespread adoption. Maybe one day there will be an “Ethereum killer” emerging, but right now there isn’t anything that can bring the network that Ethereum has, so network effects work in favor of ETH. One day it could reach a higher market capitalization than Bitcoin, an event called “the flippening” which is expected by a number of crypto buffs to happen.

But it won’t be one or the other, multiple cryptocurrencies can coexist.