Yes; I don’t know why the UK police do this. They have always been like that; I recall some appalling laziness examples from 40 years ago.

The trash papers claim they spend their time reading social media and enforcing “hate speech” etc etc but I don’t believe that, and anyway they would need a court order every time they want to go after somebody, to get their details from the utterly useless outfits like FB. And it would be a multi-stage process because so many people are on FB under nicknames and gmail addresses.

That said, the police seem to have major problems in every country, in their “customer interface”. The UK police are actually quite passive nowadays and keep away from anything that needs a brain to be switched on. If they carried a 9mm, the result (much more arrogance) would be just like every other police force.

My instance was an aircraft for sale. I offered the police the contact landline phone number and the bank account number while the scammer still thought I was hooked. They weren’t interested.

That’s absolute failure of police doing their job.

The loss I had (identical method) used Regions Bank – a US bank set up for poor people with little or no ID and maybe no fixed address.

Out of interest how did that idea arise? I’m trying to imagine somebody trying to open a US bank account with little or no ID, given the banking (tax collection) laws that apply. It is true that nobody in the US has a registered address – your address is what you say it is at any particular moment and if somebody wants you to prove it to their satisfaction they might ask to see a utility bill.

I’m not familiar with Regions Bank as they operate mainly in the southeast corner of the US, but they have 1,454 physical branches and seemingly the same other attributes as any other retail banking chain.

‘In most countries attempted crime is still a crime."

In Scotland (and the rest of the UK?) theft is often not investigated. I have little doubt that, had I recorded the scammer addressing me as “Mr M”, and told the police I had transitioned, the hate crime would have gone to court.

My instance was an aircraft for sale. I offered the police the contact landline phone number and the bank account number while the scammer still thought I was hooked. They weren’t interested.

The scam failed as I needed to see the aircraft.

The thing which saved you was prob99 that Citibank didn’t do the KYC properly, but they were not going to tell you that

The loss I had (identical method) used Regions Bank – a US bank set up for poor people with little or no ID and maybe no fixed address. Admittedly I should have smelt a rat with a Chinese supplier using a US bank, but fraud / tax evasion is standard in China so I thought it was normal  One of the clues was in the email headers (the reply-to: header) and another one (which most people would not spot, because they use modern email software) was that the email was html-only whereas the real supplier’s emails were html+plain.

One of the clues was in the email headers (the reply-to: header) and another one (which most people would not spot, because they use modern email software) was that the email was html-only whereas the real supplier’s emails were html+plain.

I had a £50k fraud at work 15 years ago, from an invoice with amended payment details.

My bank (Natwest) was completely useless: “your fault, your problem”.

The supplier wasn’t any help either.

After a lot of time on the phone we found someone senior in the fraud department of the receiving bank, who managed to return the funds from the Chinese account. We were very lucky Citibank had a UK office, took it seriously, and someone with enough authority took a personal interest.

It’s not easy to independently check international bank details: emails hijacked, zero ELP on the telephone, fax no longer in use, ungrammatical WeChat invitation…

In most countries attempted crime is still a crime. We don’t reward unsuccessful criminals by not prosecuting them.

“If you suspect fraud, you notify police or other government agency (depending on country and legislation).”

In Scotland, unless there’s been a recent change, Police Scotland will take no action, but will offer a crime number to you if you have lost .money.

They would not record bank account details which I had not payed money into.

In particular case the question is why would somebody contact a bank where allegedly fraudster’s account is located if he/she is not a client of that bank. And why would the bank respond.

The fraud prevention simply doesn’t work in this way. If you suspect fraud, you notify police or other government agency (depending on country and legislation). The other option is to inform your bank and let them deal with it, launching investigation, notifying other clients if necessary.

If you want to test this, choose random bank in let’s say Spain or France and write them you received suspicious email from someone who claims to be their client, asking you to execute some payment. And let me know if they responded and when.

It’s not about Revolut, they are ok, it’s about how the system works.

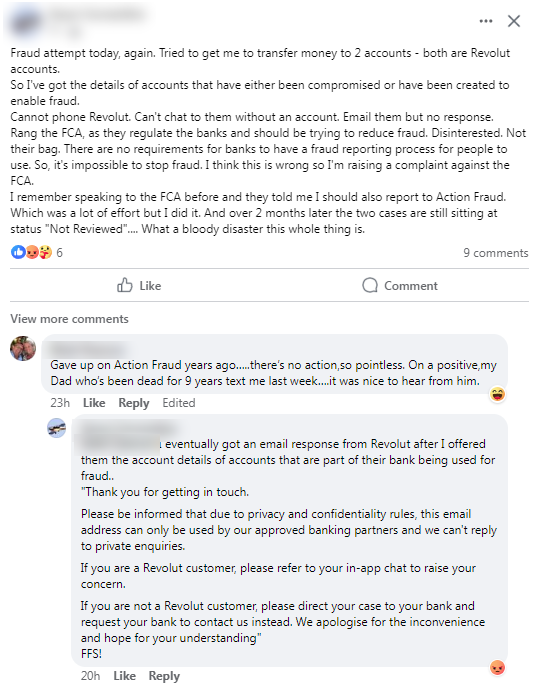

This is an example of how the outfit calling itself Revolut behaves

I know this guy.

They were similarly disinterested when somebody extracted 6k out of my bank using some Revolut-related scam.

Mind you, Lloyds Bank is only a slightly smaller bunch of incompetent tossers, blocking your account if you phone them up and are then unable to receive an SMS message because you live in a place known as “the countryside” (a piece of heavy sarcasm I enjoyed using to some Lloyds member staff recently)

The problem is that the entire “retail financial services” sphere is full of sh*it. They have over-interpreted the regs (KYC – know your customer – etc) while big banks have been openly money laundering hundreds of millions. I am involved in a case right now (can’t post details, but retail mortgage related) which shows that basically everybody down the line is an anally retarded idiot. One of the funniest things is that this has led to ID solutions like Thirdfort where somebody is storing enough data on a web server to completely destroy all customers for ever if the server was ever hacked.

There is only one solution: have multiple approaches. Multiple cards, etc.