As I understand it, there are some substantial tax benefits in the U.S. at the moment when you buy a new aircraft – at least if you buy it for a company I think. I also know of no similar scheme in any European country.

What that means to a European aircraft buyer is probably that you need to be stupid to buy any new GA aircraft in the current market. It would be much better value for your money to pick up an American pre-owned aircraft, which would hopefully factor in some of the tax benefits in its resale price. Of course, it has always been the case that aircraft depreciate very quickly in the first few years, but this tax rule seems to exaggerate the effect.

My question is: Is the market for new GA aircraft in Europe completely dead, or are there exceptions? If so, which models still sell new, and is it only because there is nothing similar available pre-owned, or the buyers just don’t care about the price? Or can a rational economical case be made for buying new in Europe? Does it vary by country?

AFAIK you can get VAT back if the plane is chartered. Even when you’re the only customer in the end. There was a case where someone bought and operated two Falcons like this and ECJ ruled it was IAW the law. And you can obviously write off an aircraft if you have it for business. I also imagine leasing an aircraft isn’t different from leasing a car. But these things probably differ between countries.

What benefits do you mean?

Yes, it’s possible to buy with a company, get all of VAT back and rent to yourself. Not complicated. Takes a month or two for VAT to be returned as tax authority will control the company before they return VAT.

Not in the UK. The taxman wants to see a business plan before authorising the refund on the (obviously substantial) VAT reclaim of the aircraft purchase. Been there, done that… The reason is probably obvious but the main part is to prevent people setting up “hobby businesses” which don’t really trade but bring the owner a 20% saving. Hence every country will have some similar rule otherwise everybody with an expensive hobby would set up a company, buy the stuff, apply the maximum capital allowances, and then sink the company, repaying the VAT on a much reduced market value

Of course the downside of VAT registration is that the business has to charge the owner 20% extra for the flying, and this extra cost is for ever, although the original VAT reclaim is only a one-off saving

So I don’t see the connection with new aircraft sales. The ability to reclaim VAT hangs on the buyer being a VAT registered body, and you can do it equally on a used plane (if currently and always previously owned by a VAT registered body).

People buy new planes for all kinds of reasons… latest gadgets, no other way to get a required spec, fresh leather smell, pose value, warranty, etc. Same as cars really.

Does anyone have SR22 and DA40/42 annual sales in units for say the past 15 years?

A kind of secondary question: how does VAT work on wet rentals? (I don’t rent and I don’t have a business…) For example, if a flying club rents you a plane wet, do they get to reclaim the VAT on the fuel but charge you VAT on the wet rate, or do they still pay VAT on the fuel and you pay VAT on the rental rate, in other words you pay VAT on VAT? (Already I think it’s a bit unjust that VAT is applied after duty on fuel rather than before – it becomes a tax tax)

There are quite a few brand new sales of bigger aircraft, jets and turboprops. Of course these are almost always bought by companies, and on the rare occasion they are privately purchased they are often put onto an AOC to justify the VAT reclaim.

A VAT registered business reclaims all VAT on purchases, and charges VAT on all sales. Some exceptions e.g. cars, but not vans.

So you don’t pay VAT on VAT.

But obviously you the end customer do pay more than if the supplier was not VAT registered. So a VAT registered company is less competitive. So everybody who sells to non VAT registered customers (e.g. the public) tries to keep their business below the mandatory VAT threshold (currently £83k)

Lots of people who bought an expensive plane try to rent it out to justify the VAT reclaim. The most obvious difficulty is that you don’t want to let just anybody fly it (because it would get trashed) and this reduces the pool of customers. Been there, done that, too, and have written about it here previously – example. Loads of people who bought light jets lease them to an AOC operator to recoup some money, hoping that the company will put enough hours on it.

But this isn’t directly related to buying a new plane. A lot of used planes are for sale as “plus VAT” – example. These are extra interesting to VAT registered customers who are in a position to reclaim the VAT legitimately.

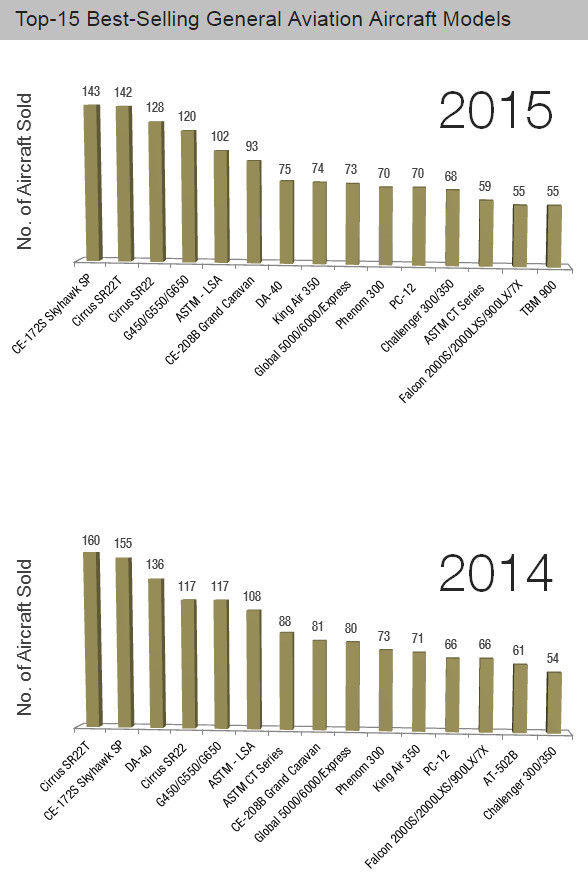

which models still sell new

The ones which are still made, which these days isn’t very much… SR20, SR22, DA40, DA42 mainly in the light GA certified sector, plus loads more in the UL etc sectors.

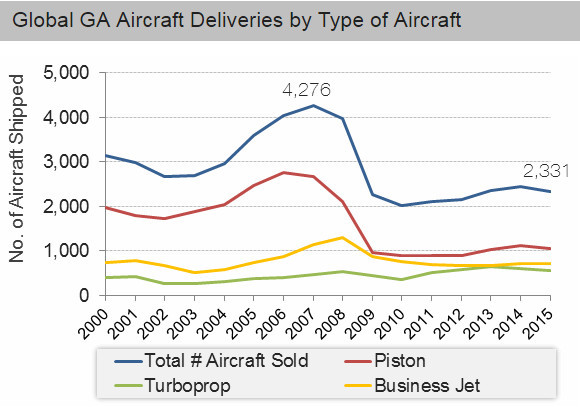

Big drop for the piston business c. 2009 e.g.

loco wrote:

Yes, it’s possible to buy with a company, get all of VAT back and rent to yourself. Not complicated.

There is a special provision in the VAT regulation for planes used to transport paying public (scheduled, charter, doesn’t matter, but there are some conditions; something like mainly international routes, etc.). That ruling I mentioned concerned this, not an ordinary claim of VAT on a business tool. I would have to look it up but there might be actually 0 % VAT on these planes.

Peter wrote:

Hence every country will have some similar rule otherwise everybody with an expensive hobby would set up a company, buy the stuff, apply the maximum capital allowances, and then sink the company, repaying the VAT on a much reduced market value

If you do something stupid and obvious, they might come after you. For me the main reason for thinking about such a scheme would be preservation of value – unless I find a buyer in the EU that wouldn’t be able to claim VAT back, I’m at a considerable disadvantage. And that’s a small market, especially for more expensive planes.

Martin wrote:

What benefits do you mean?

First of all, if I were an expert on how it works in the US, I wouldn’t have asked about it here. It is just based on what you read on US forums about the “current favorable tax rules” which many people cite when they announce that they just bought a new plane. But I found this article, which says that it’s mainly about the depreciation rules:

Under the Bonus Depreciation rules, purchases of new aircraft, as well as purchases of new equipment installed in used aircraft, are eligible for an accelerated bonus-depreciation allowance in the year they are placed in service. For tax years 2015, 2016, and 2017, the bonus-depreciation allowance will be 50% of the cost; this reduces to 40% in 2018, 30% in 2019, and is phased out thereafter (although some 2020 acquisitions may qualify, where a written binding purchase contract was in place before 2020). The additional first-year depreciation deduction is allowable both for regular income tax purposes and alternative minimum tax. Aircraft eligible for bonus depreciation must be new, used primarily for qualified business purposes, and meet other tests necessary to qualify for depreciation under the modified accelerated cost recovery system (MACRS).

To me, accelerated depreciation sounds like a “buy now, pay up later” deal, because when you sell the aircraft you’ll have to make up for whatever difference there is between the value and sale price anyway.

In addition, I think several states (like Nebraska) have passed exemptions to sales tax on new planes.

alioth wrote:

For example, if a flying club rents you a plane wet, do they get to reclaim the VAT on the fuel but charge you VAT on the wet rate, or do they still pay VAT on the fuel and you pay VAT on the rental rate,

If the club is a non-profit organization like in France, then it is exempt from VAT altogether. It doesn’t get to reclaim VAT on its purchases, but it also doesn’t charge you any VAT. Otherwise I would expect a rental business to reclaim VAT on all fuel purchases made in its name, and charge VAT on the whole wet rental price.

But my question really wasn’t so much about VAT actually.

Peter wrote:

SR20, SR22, DA40, DA42 mainly in the light GA certified sector, plus loads more in the UL etc sectors.

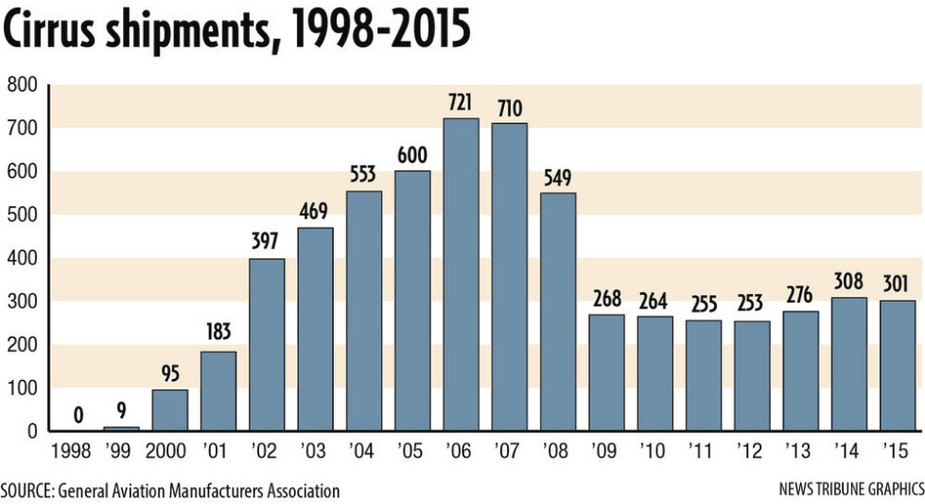

I’d be interested to know how many new planes Cirrus for example sells in Europe vs. the US, and compare that to used airplane sales. Diamonds may be somewhat a different story because they are mainly used by flying schools, I think.

Rwy20 wrote:

If the club is a non-profit organization like in France, then it is exempt from VAT altogether. It doesn’t get to reclaim VAT on its purchases, but it also doesn’t charge you any VAT. Otherwise I would expect a rental business to reclaim VAT on all fuel purchases made in its name, and charge VAT on the whole wet rental price.

A non-profit organisation is not necessarily exempt from VAT and if it is run by unpaid volunteers it could actually be an economic advantage to be VAT registered.